Related Podcasts ...

Working for yourself

There are lots of different reasons why University of Exeter graduates may want to work for themselves. It could be to do with the nature of the sector you are interested in working in, your preferred working style or the flexibility you need due to your personal circumstances.

There are different ways you can work for yourself, such as being self-employed or through freelance and portfolio careers.

Many graduates will aspire to owning their own business in the longer term but choose to gain experience in related sectors before taking this option.

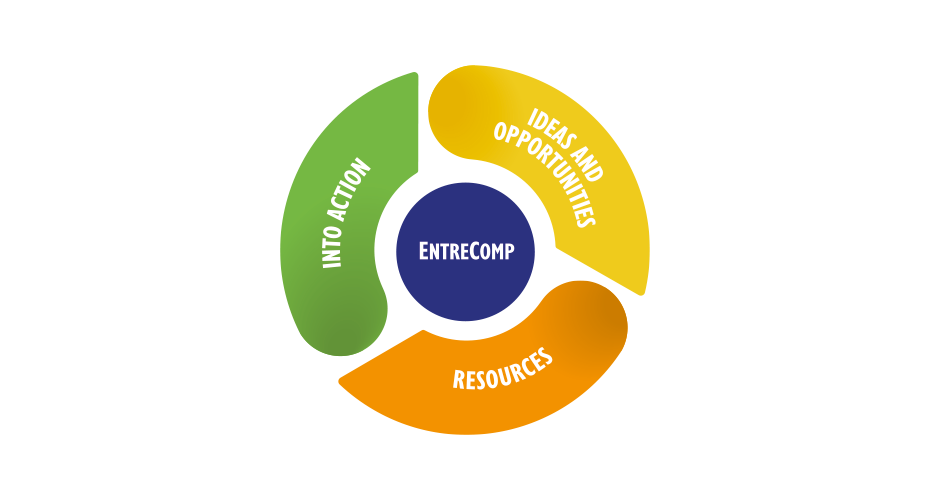

Whichever path you choose you will need to develop strong entrepreneurial competencies to succeed in it.

- Social Entrepreneurship – a Career Zone Guide to social enterprise.

- If you are considering self-employment or entrepreneurship, you can book a 1:1 guidance appointment with a Careers Consultant, or participate in workshops.

- Explore idea generation with Student Start Ups. The Student Start Ups team run workshops on ‘Ideation’ as well as bootcamps for students looking to gain an experiential understanding of what it means to be an entrepreneur.

- If you already have an idea of what you want to do, the Student Starts Ups Team provide support for taking your concept forward.

- Reference Books available from the Careers Zone: Start up and Run Your Own Business, The Beermat Entrepreneur, Working for Yourself, Start and Run a Business from Home.

- Moving into Self Employment - My Career Zone Digital.

‘Going freelance’ means setting yourself up as a business. To do this, you have to formally set up a legal business structure and let the tax authorities know that you are operating.

You need to be aware that ‘freelance’ is a layman’s term, and not an official category used by the Government to classify workers. Freelancers themselves use different terms to describe what they are, such as freelancer, contractor, consultant, independent professional, interim, portfolio worker, self-employed, business owner.

The unifying factor is that freelancers are their own bosses and have business-to-business relationships with their clients. There is a strong tradition of freelancing in certain industries such as media, IT, consulting; artists and designers often freelance as they work on short-term projects. Therefore, some freelancers work on long-term contracts, others on a series of fast turnaround projects, whilst others work with several clients at a time.

As a freelancer, you can use a range of legal structures to run your business. Please see the table below for the most used trading structures:

| Trading structure | Legal category* | Your tax status |

| Sole trader | Unincorporated | Self-employed |

| Partnership | Unincorporated | Self-employed |

| Limited liability partnership | Incorporated | Self-employed |

| Limited company | Incorporated | Company director and/or employee of your company |

*Incorporated = your business is a legal separate entity; Unincorporated = you and your business are one and the same, there is no legal separation

Some freelancers work through recruitment agencies. It is important to remember that if you are a sole trader, you can only be paid by the end client and not by the recruitment agency. In this case, you invoice the client directly and the agent charges the client a separate commission for finding you. Other freelancers work directly with their clients. IPSE offer a lot of useful advice for freelancers.

Because as a freelancer you are contracting your services to a client, it is important to draw up a contract with your client for the services your business will provide. Therefore, this is not a contract of service with you personally but with your business. The contract should accurately reflect the relationship between the two parties, and should include (a) clauses that demonstrate your ability to send substitutes, (b) the lack of mutuality of obligation and that (c) you have direction and control over your work.

As with any business, remember that you need to have insurance that is required by law as well as insurance for what makes sense from a commercial point of view.

To find out more about the above, please search the resources on the IPSE website.

Each year a few students choose to go self-employed and start their own business directly after graduation and most of these have had experience of entrepreneurial activities before and during their degree course.

Many sectors and careers lend themselves well to self-employment, including journalism, certain legal and medical professions, and the creative and performing arts sectors.

The financial help offered by The Princes Trust and Shell Livewire make starting a business a realistic option and we offer lots of training and events to help you realise your dream; please visit Student start-ups to find out more.

Career Zone Podcast

Listen to the Career Zone Podcast episodes:

- Value of doing a placement for setting up your own business. Listen on Spotify| Apple Podcasts.

- What it actually means to be a freelancer. Listen on Spotify | Apple Podcasts.

- In conversation with Sawsan Khuri, Innovation Specialist and Facilitator. Listen on Spotify | Apple Podcasts.

- In conversation with alumni Amy Matthews, Comedian. Listen on Spotify | Apple Podcasts.

Webpages

If you would like to do further research into this sector, the following webpages may be useful.

- Prospects provides an overview of what it means to be an entrepreneur, the skills required and an exploration of finding out of self-employment is right for you.

- Princes Trust: advice and financial help for starting your own business.

- Business Link: useful advice on finance and start ups.

- Company Partners: puts business partners seeking opportunities to start a small business, in contact with other entrepreneurs who may have ideas or funding to invest.

- HM Revenue & Customs Advice: start up advice on law, tax, regulations etc.

- Informi: a free website dedicated to supporting the UK’s small business community.

Information and links from professional bodies

Being a member of a professional body is voluntary, however it can be valuable for developing networks, continuing your professional development, and generally keeping up to date with what's happening in the sector.

- SFEDI (Small Firms Enterprise Development Initiative): advice and on-line courses for small businesses and start ups.

- British Venture Capital Association: the industry body and public policy advocate for the private equity and venture capital industry in the UK.

- British Franchise Association: Supporting and educating franchisors and franchisees at every level of their development from newcomers to household names, setting the highest ethical standards to make sure everyone is treated fairly.

- IPSE: The Association of Independent Professionals and the Self-Employed, is the UK’s only not-for-profit association dedicated to the self-employed.

Making contacts

Making contacts is essential for success in this and other sectors. Success in this field can come through networking and speculative applications. You could start by speaking with the experts – find out what they did after graduation and contact them for advice using the Career Mentor Scheme or Ask An Alum.

Events

Recruitment fairs, open days, talks, and events give insights and opportunities to make contacts. For details of future events visit Handshake. If you have not yet activated your account, select the Single Sign On (SSO) option and follow the onscreen instructions.

Getting a graduate role is competitive. Undertaking relevant work experience will not only make your applications stand out, but it will also allow you to develop new skills and gain a valuable insight into the sector.

The Student Start Ups Team, sometimes in collaboration with the Career Zone, run events throughout the year, where you can meet entrepreneurs, develop your skills and your networks.